Wide range of solution. A hedge inherently reduces your exposure.

Hedge Management Gopa Kumar S

Hedge Management Gopa Kumar S

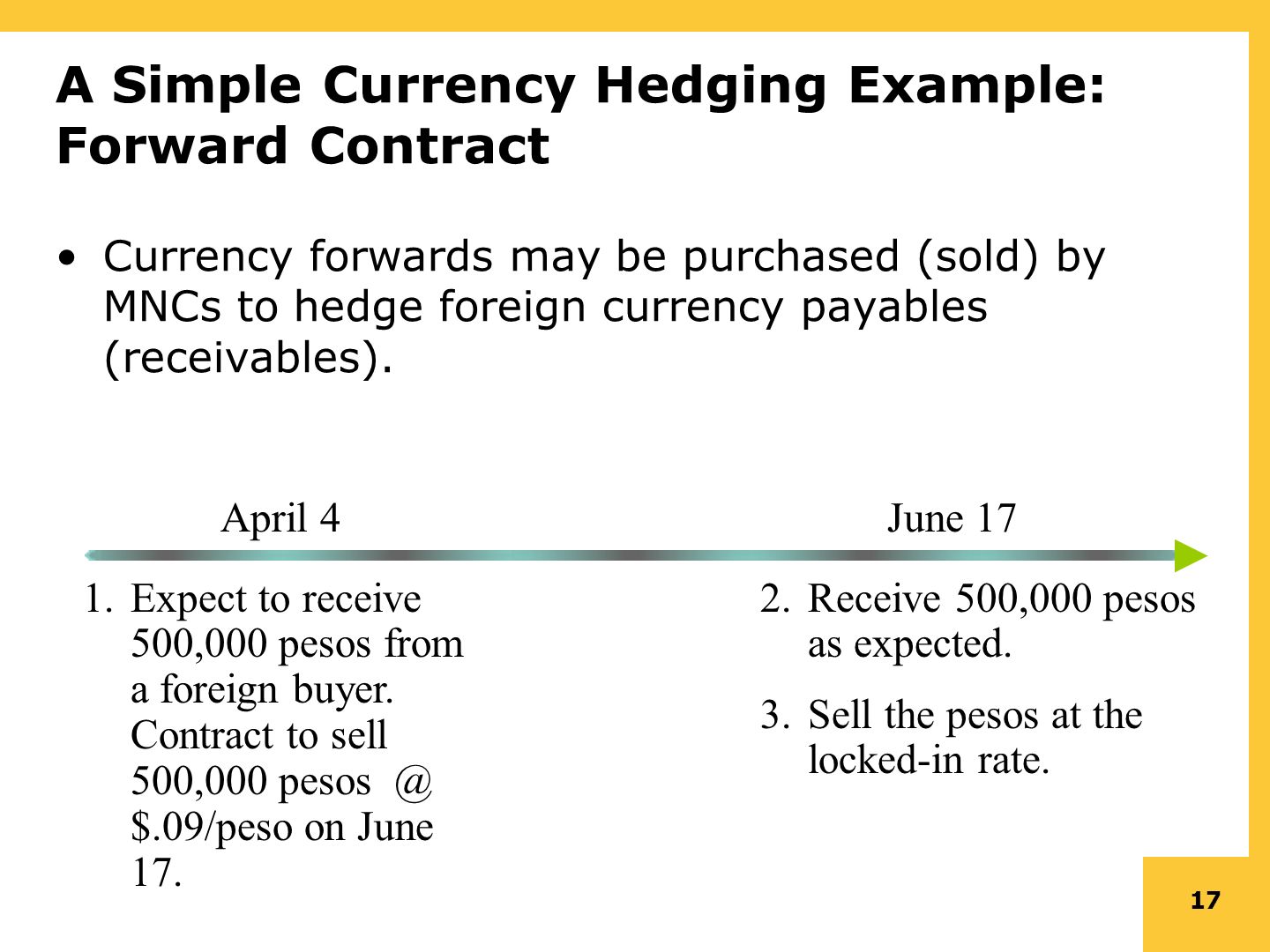

Currency hedging forward contracts are really very simple.

Forex hedging contract. This reduces your losses if the market moves adversely. Forex hedging ist eine massnahme mit der sie sich gegen volatilitat absichern konnen. The scenario is as follow.

Understanding and applying currency hedging forward contracts. Final words about forex currency hedging. Hedging currency ri! sk is a useful tool for any savvy investor that does business internationally and wants to mitigate the risk associated with the forex currency exchange rate fluctuations.

A forex hedge is a foreign currency trade thats sole purpose is to protect a current position or an upcoming currency transaction. Hedging is a strategy to protect ones position from an adverse move in a currency pair. Key difference hedging vs forward contract the key difference between hedging and forward contract is that hedging is a technique used to reduce the risk of a financial asset whereas a forward contract is a contract between two parties to buy or sell an asset at a specified price on a future date.

Erfahren sie hier wie sie hedging strategien einsetzen konnen. In this currency hedging guide were going to outline a few standard and out of the box currency risk hedging strategies. Ultimately to achieve the above goal you need to pay someone else to c! over your downside risk.

100000 fwd rate! 48 conclusion date 03072009. In this article ill talk about several proven forex hedging strategies. But if the market moves in your favour you make less than you would have made without the hedge.

Hedging is a way of avoiding risk but it comes at a cost. Enjoy a wide range. I am trying to evaluate a forex foward contract scenario.

They allow either individuals or businesses with exposure to currency risk to protect themselves from adverse moves in the foreign exchange market. Protect your business through risk management strategies with standard chartered foreign exchange forex and hedging solutions get in touch a range of forex and hedging solutions hedge against the risks of currency interest rate and commodity market fluctuations that may affect your business with effective risk management services. Forex traders can be referring to one of two related strategies when they engage in hedging.

There are tra! nsactional costs involved of course but hedging can also dent your profit.

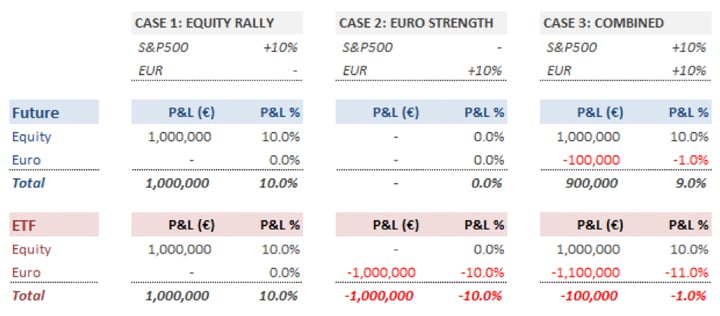

Intl Investing Currency Risk In Equity Portfolios Cme Group

Intl Investing Currency Risk In Equity Portfolios Cme Group

Drawbacks Of Common Hedging Methods The Hindu Businessline

All You Need To Know About Forward Contracts

All You Need To Know About Forward Contracts

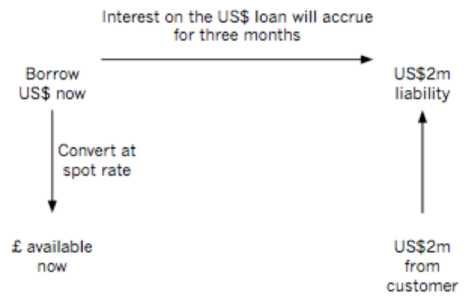

Foreign Currency Risk And Its Management Acca Qualification

Foreign Currency Risk And Its Management Acca Qualification

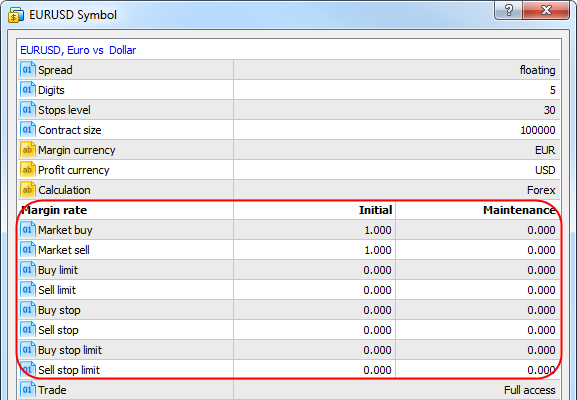

Margin Calculation Retail Forex Futures For Advanced Users !

Margin Calculation Retail Forex Futures For Advanced Users !

Calameo Fluctuations In Forex Transactions Can Be Monitored Via

Calameo Fluctuations In Forex Transactions Can Be Monitored Via

![]() Differences Between Swaps Forwards And Futures

Differences Between Swaps Forwards And Futures

Foreign Exchange Risk

Foreign Exchange Risk

3 Ways To Hedge Currency Wikihow

3 Ways To Hedge Currency Wikihow

Chapter 6 The Foreign Exchange Market Overview Ppt Download

Chapter 6 The Foreign Exchange Market Overview Ppt Download

Hedge Finance Wikipedia

Hedge Finance Wikipedia

Forex Risk Management Strategy

Forex Risk Management Strategy

Fx Hedging Strategies Compass Global Markets

Foreign Exchange Hedging Tools

Foreign Exchange Hedging Tools